In a fresh filing, Intel said the stake could put a dent in overseas sales, disrupt future grant applications, and subject the firm to a host of awkward restrictions.

The stake comes courtesy of $11 billion in converted subsidies, part of the CHIPS and Science Act cash pile, with $5.7 billion still unpaid from the 2022 round and another $3.2 billion tied to the Secure Enclave programme.

Despite the financial windfall, Intel’s filing reads more like a list of caveats than a victory lap. The chipmaker frets that other state entities might follow suit, trying to turn existing grants into equity or balking at offering new ones.

International trade headaches could follow, with foreign regulators treating Intel differently now that Uncle Sam owns nearly a tenth of the shop.

Last year, a chunky 76 per cent of Intel’s revenue came from overseas, with Chinese punters alone contributing 29 per cent. If foreign governments start crying foul over US influence, that cash flow could start looking less secure.

Intel chief executive Lip-Bu Tan doesn’t seem all that worried. In a video published by the Commerce Department, he said, "I don't need the grant. But I really look forward to having the US government be my shareholder."

That enthusiasm might not be shared by Intel shareholders, who now have to contend with dilution from the discounted shares sold to the government. Chipzilla is handing over shares at $4 below Friday’s close of $24.80, which caused shares to tick up slightly to $25.25 on Monday morning.

This hands the government not just a slice of the pie but a potential say in how it’s baked. Intel warned that Washington’s "substantial additional powers" might block deals or strategies that would otherwise benefit private investors.

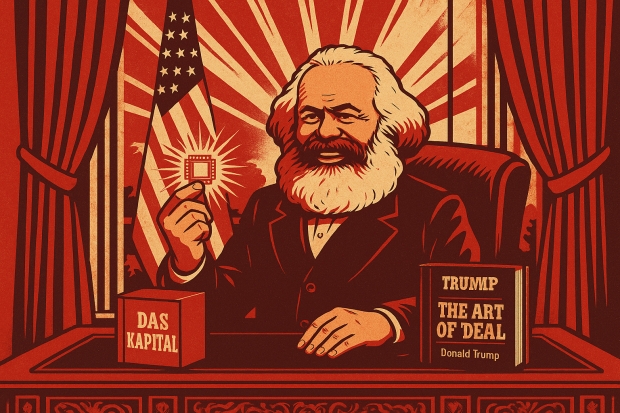

Tan’s deal with the Trump reportedly followed a tense chat after the President demanded Tan resign due to past links with Chinese firms. Now that the handshake’s done, Intel’s on the hook with a shareholder that doesn’t just want quarterly returns, but regulatory leverage too.