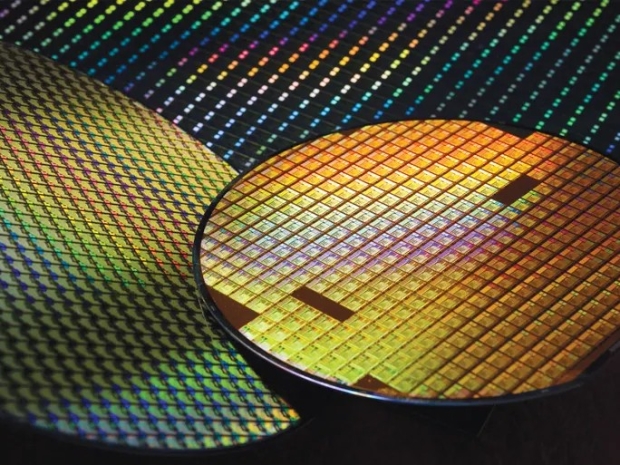

TSMC, which hoovered up more than 70 per cent of foundry revenues in the second quarter of 2025, plans to lift prices on sub-5nm nodes by 5 to 10 per cent starting in 2026.

The big kick in the teeth comes with the 2nm jump, where wafer prices will soar by more than 50 per cent. A 300mm wafer on the current 3nm process runs around $20,000 (€18,400). At 2nm, that shoots up past $30,000 (€27,600).

For the first time in a major node transition, the cost per transistor will rise instead of fall. That means the foundry game is no longer about cheap access to cutting-edge silicon but about paying a premium for the privilege of staying competitive.

The drivers are obvious: geopolitical arm-twisting, spiralling fab costs, and physics itself. Building a US fab in Arizona has turned into a $165 billion (€152 billion) sinkhole, the biggest foreign direct investment in US history.

AMD boss Lisa Su admitted chips fabbed in Arizona cost five to 20 per cent more than those made in Taiwan, with some whispers suggesting 30 per cent higher for 4nm. TSMC says price hikes are “unavoidable” to protect its 53 per cent gross margin target.

Meanwhile, the physics wall is looming large. Moving from FinFET to Gate-All-Around transistors at 2nm adds insane complexity. Multi-step selective etching, nanosheet stacking, and stochastic EUV defects mean yields are harder to achieve and costs skyrocket. One EUV scanner costs $350 million (€323 million), and fabs themselves cost $15–20 billion (€14–18 billion) a pop.

Nvidia boss Jensen Huang says he “fully supports” TSMC charging more and even calling it “one of the greatest companies in the history of humanity”. Easy for him to say when his GPUs already sell for thousands and the wafer is only a fraction of the total sticker price.

Apple is less thrilled. The company admitted tariffs cost it $800 million (€738 million) in Q3 2025 and expects that to balloon to $1.1 billion (€1.01 billion) next quarter. To curry favour with US regulators, it has pledged an eye-watering $600 billion (€553 billion) into domestic production.

Qualcomm and MediaTek, meanwhile, are being crushed. Reports say MediaTek is facing a 24 per cent hike for its N3P chips and Qualcomm about 16 per cent. Qualcomm boss Cristiano Amon muttered that he would “like Intel to be an option” but then admitted Troubled Chipzilla is still not capable of fabbing mobile silicon at competitive yields.

For punters, it means more expensive Android flagships from 2026 onwards, while data centres will face a much higher floor for AI accelerator costs. A wafer that once cost $20,000 (€18,400) now hitting $30,000 (€27,600) guarantees that AI kit won’t be getting cheaper any time soon.

The only silver lining is chiplet architectures. AMD has been showing how to split designs across cheaper mature nodes while reserving bleeding-edge wafers only for the core logic. That trick is less clever engineering and more raw economic survival.