Two sources familiar with the matter told the Financial Times that state-backed buyers such as mobile operators, utilities and large industries have started applying far stricter scrutiny to foreign bids.

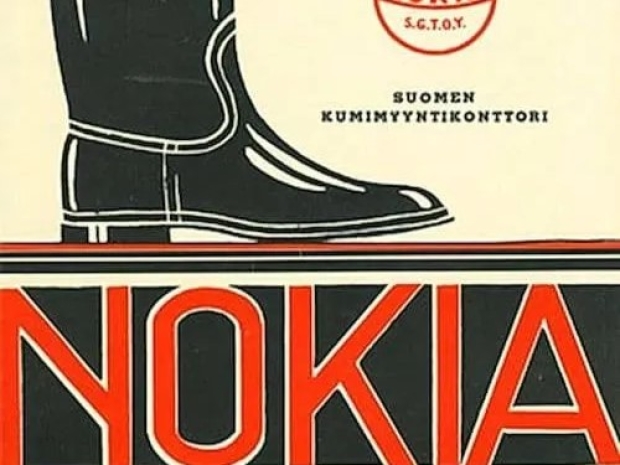

Contracts from the former rubber boot maker Nokia and Sweden’s Ericsson are being forced through “black box” national security reviews run by the Cyberspace Administration of China, with no explanation of how their hardware is judged.

These reviews can drag on for three months or more. Even when the European firms are approved, the delays give Chinese rivals an easier ride.

“If China is doing this for national security reasons, the question is why Europe does not reciprocate by applying the same standard,” said one person close to the process told the FT.

The Chinese effort mirrors Europe’s slow-motion clampdowns on Huawei and ZTE, though in practice European governments have been far less effective at curbing Chinese market share.

Xi has been pressing for self-reliance in technology since a 2022 update to China’s cybersecurity law. That change forced operators of “critical information infrastructure” to submit all potentially risky purchases for CAC review.

Foreign bidders are now required to provide exhaustive documentation on components, local content and even details of Chinese R&D projects in an attempt to curry favour.

Customers then hand over the dossiers to CAC, which informs the state-owned buyers if they can go ahead.

Dell’Oro Group analyst Stefan Pongratz said the restrictions have gutted the Son of Eric and Nokia’s presence. Their combined share of China’s mobile telecom market fell to about four per cent last year, down from 12 per cent in 2020.

Both companies have seen revenues in China shrink, with Nokia reporting double-digit declines since 2023.

“It’s so slow that even the breadcrumbs of market share the European companies get from major tenders are often shifted to Chinese vendors,” another source complained.

The EU Chamber of Commerce in China warned that localisation demands in telecoms pose an “existential threat” to European groups. Nearly three quarters of its members in a recent survey said they had lost business.

While European policymakers continue to talk about security risks and the dangers of backdoors in Chinese equipment, most have hesitated to impose outright bans. Cheaper gear and the fear of upsetting Beijing have kept them cautious.

Research outfit Cullen International said five years after the European Commission urged member states to restrict Huawei and ZTE, only 10 out of 27 EU countries had done so by June 2025, according to

Huawei and ZTE still hold between 30 and 35 per cent of Europe’s mobile infrastructure market, down only five to ten points since 2020.

Strand Consult's John Strand said Germany is particularly exposed, with 59 per cent of its installed 5G equipment sourced from Chinese vendors. Berlin says it will phase them out by 2029, though that is a long way off.

“All the mobile network equipment in Berlin is Chinese, Germany has big industries like chemicals and cars that don’t want relations with China to be hurt,” Strand said.